Miss Krystle Breaks Down the HITS Act—and Warns Artists Not to Fall for the Hype

- Mars

- Jul 11, 2025

- 3 min read

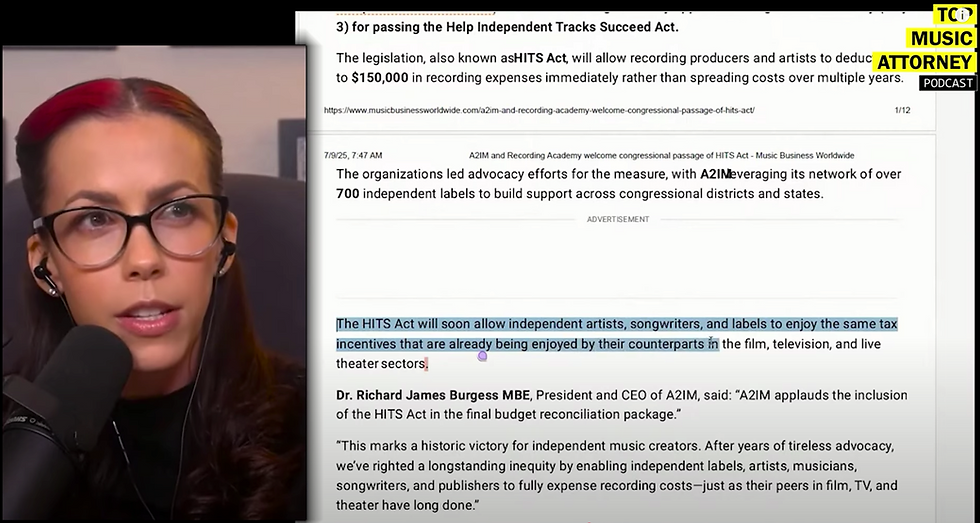

As news spreads about a new $150,000 tax break for musicians, entertainment attorney and artist Miss Krystle wants indie artists to pump the brakes on celebrating. While the Help Independent Tracks Succeed Act—better known as the HITS Act—has been marketed as a win for creators, Krystle says the headlines are misleading and potentially harmful for artists who don’t fully understand what the law actually offers.

“I keep seeing titles like ‘indie artists get $150,000 tax credit,’ and it’s just not true for most people,” Krystle said in a recent explainer. “To even qualify, you’d have to spend $150,000—and probably make it too.”

Who Really Benefits From the HITS Act?

At first glance, the HITS Act seems like a progressive shift: it allows eligible music creators to deduct up to $150,000 in recording expenses in the same year they were incurred, instead of spreading those deductions across multiple years. This aligns music more closely with industries like film and television, where such deductions are already standard.

But Krystle breaks down why this tax advantage won’t benefit the average independent artist. “This is good for midsize labels, sync companies, and some well-funded indies,” she explained. “But it’s not changing anything for most indie artists, because they’re not spending—or earning—anywhere near that much.”

She noted that regular business expenses—like travel, marketing, and studio time—have always been deductible, regardless of legal structure. “You don’t need an LLC to write off ordinary business expenses,” Krystle emphasized. “That hasn’t changed with the HITS Act.”

What has changed is how recording production costs, a more specialized category, can now be deducted immediately. Previously, these were considered long-term capital expenditures that had to be amortized—spread out over several years.

“For a big investment, the IRS wouldn’t let you write it off all at once,” Krystle said. “Now, if you spend a hundred grand to make an album, you can deduct it right away. But again, most artists aren’t dropping that kind of money.”

A Shield for the Few, Not the Many

Krystle warns that predatory businesses might use the HITS Act to convince unsuspecting artists to spend money they don’t have. “I’ve already seen people saying, ‘Go hire the top mixers and mastering engineers because it’s all tax deductible now,’” she said. “That’s incredibly misleading.”

She argues the law will primarily benefit midsize music companies that operate just below the threshold of major label territory—companies that are savvy enough to manage six-figure budgets but small enough to still qualify for the deductions. “It’s not for the ‘supergiants’ like the major labels, but it’s definitely not built for the average bedroom producer either,” she said.

Artists should also understand the cap: even if they spend more than $150,000 on an album, the tax benefit stops there. Anything beyond that has to be deducted the old way—over time.

Tie-In: Copyright Strikes and Legal Overreach

This isn’t the only issue Krystle has flagged as problematic for creators. In a separate video, she criticized Universal Music Group (UMG) for weaponizing copyright strikes against YouTube creators, many of whom are musicians themselves. Channels like Knox Hill’s have faced deletion threats over alleged violations—even in cases that may qualify as fair use. “Universal is using copyright as a weapon,” she said. “It’s legal warfare.”

She urges creators to understand their rights and respond with DMCA counter-notices when appropriate. Krystle references case law like Lenz v. Universal Music Corp to show that fair use is a protected right under U.S. copyright law, even if platforms don’t always uphold it properly.

AI and the Next Legal Battle

Krystle is also leading a class action lawsuit against AI music platforms Suno and Udio for allegedly using copyrighted songs to train their models without compensating artists. Her team is recruiting plaintiffs—particularly indie musicians—at IndieAILawsuit.com.

“This is about ownership,” she said. “Artists need to protect their work at every level—from tax law to AI to copyright strikes.”

The Takeaway: Know Your Rights, and Know the Limits

Krystle’s main message is clear: don’t rely on headlines or surface-level advice. Artists need to understand the law, not just the Instagram version of it. “Yes, this can be a win,” she said. “But only for a specific group of creators. If you’re not spending $50K–$150K per project, this doesn’t really move the needle for you.”

Instead of rushing to overspend or restructure a career around a misunderstood tax incentive, Krystle urges indie artists to stay focused on the fundamentals: track your expenses, consider forming an LLC for liability protection, and keep a separate business bank account for clean records.

“Stay protected. Stay organized,” she said. “And always read the fine print—especially when the internet tells you you’re about to get free money.”

Comments